I network with as lots of people as I can and let them know I buy all type of properties in excellent or bad condition. It takes time to find out how to speak with off-market sellers. You likewise will require to have a representative or attorney helping you with paperwork. Some of the best deals are not in fact for sale.

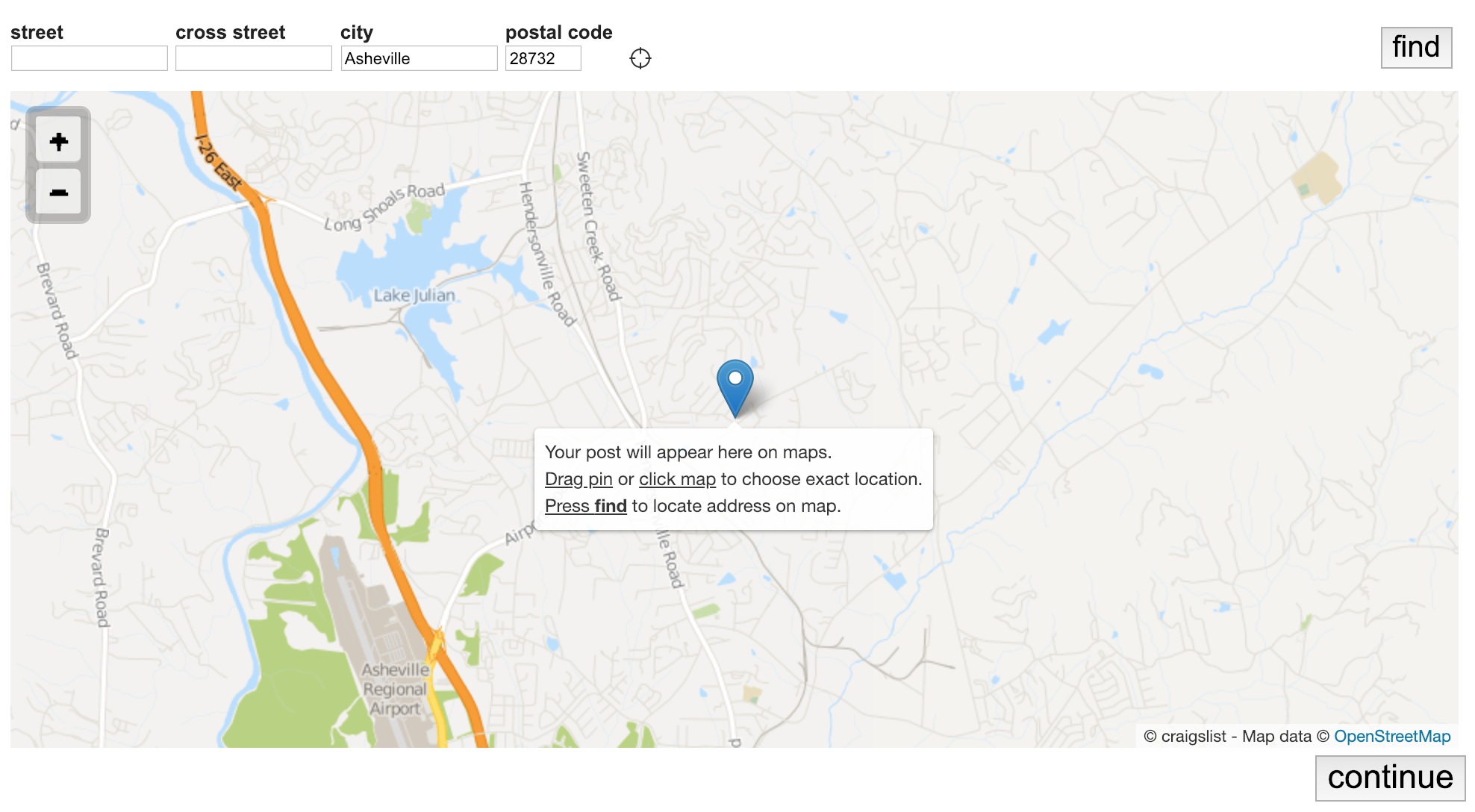

That means the seller is not using a realty representative and are attempting to offer your home on their own. I find these deals on Zillow, Craigslist, Facebook, word of mouth, and by driving around town. I likewise buy houses from auctions from time to time. We used to purchase almost all of our flips from the foreclosure auction when I dealt with my father.

I will periodically purchase from the foreclosure auction, however it is rare. I likewise buy from other auction websites like auction. com, xome. com, Hubzu, and more. You need to be really mindful buying from auctions as you may not be ensured a clear title, there might be a buyer's premium, and you may http://beauovze563.bravesites.com/entries/general/how-much-does-a-real-estate-agent-make-on-a-sale-for-beginners need cash that very same day.

Wholesalers search for houses that are listed below market price using the same methods I noted above. They will find a good deal, get it under contract, and try to sell it to another investor without doing any work to the home. I buy many offers from wholesalers. You need to always run your own numbers and not blindly trust wholesalers and understand that many individuals who say they are wholesalers will never ever actually do deals.

It can be a method to get your foot in the door with less money than purchasing a rental or turning, but it takes time and difficult work to make it as a wholesaler. A lot of wholesalers utilize the methods above to find offers, get them under agreement, and is timeshare worth it then sell those agreements or complete a double-close to rapidly offer the home to another financier.

I have actually found out a lot after buying hundreds of homes, multifamily residential or commercial properties, and industrial financial investments. I have actually also discovered a lot from being in the industry and talking to numerous successful financiers. If you are looking to find out more about purchasing leasings or flipping houses, I can help. I have a training program that reviews whatever and comes with videos, a guide, e-mail coaching, and regular monthly calls with me.

It is challenging to purchase realty, but it is worth it if you want to put in time and work. I believe the ultimate goal westgate resorts timeshare is to own leasings that will offer capital for the rest of your life, but there are numerous methods to get to that objective.

Examine This Report on How To Become Real Estate Agent

Last Upgraded: May 30, 2019 Realty financial investment is a complex field, with a great deal of cash altering hands. If you want to expand your financial investment portfolio, property is a popular way to do it. This guide will help get your money invested properly.

The chances to earn money in genuine estate are limitless. If you are a realty agent or broker, you can increase your brief term and long term earnings significantly by starting to purchase property as well. As an expert on realty, you benefit from significant advantages compared to other novice investors.

The primary step to investing in rental properties regardless of whether you are a representative or not is carrying out thorough property market analysis. The concept is to take a look at property price worths and patterns, available listings, and property types for sale. It is necessary to establish if the regional market is a purchaser's market or a seller's market to understand what competitors you should get out of other home buyers.

You know the responses to most or all of these questions, which lessens the time you require to invest on market analysis. Additionally, representatives can purchase investment properties even in hot seller's markets a lot more successfully than other financiers as they are expert residential or commercial property finders and negotiators. Once you decide that purchasing a residential or commercial property in your location is a good opportunity at the moment, you should carry out rental market analysis.

You must assure that the regional market can bring you a positive capital financial investment in order to increase the quantity of cash you make from property. In addition, examining the rental need and supply in the location will inform you whether traditional, long term leasings or Airbnb, short term rental homes bring a greater rate of return.

Selecting the very best rental technique is crucially essential for the success of a rental home business. Across the country analysis carried out by Mashvisor, a real estate data analytics business, reveals that in the large majority of United States markets long term and short term rentals yield significantly various rental earnings and return on financial investment.

: Discover just how much you might make in realty in this. The next action in starting investing in genuine estate is getting pre-approved for a mortgage. As an agent, you know how essential this is. Purchasers who have been pre-approved are thought about significantly more dependable and major which is especially essential in best-seller's markets where a couple of purchasers compete for the very same property.

9 Easy Facts About Why Is It Called Real Estate Explained

You need to use your knowledge of regional monetary institutions that you have actually accumulated throughout your real estate profession to focus on the best choices. It is advised to speak with a couple of different banks consisting of both small regional and big national ones. Various credit institutions offer various interest rates and other mortgage terms.

As a first-time investor, you must set up a budget plan and adhere to it. Among the gravest errors which beginner genuine estate investors makeand against which agents are not protectedis surpassing their spending plan since they fall in love with a particular house. Buying a financial investment home is a service decision which must be based upon calculations and rationality instead of on your emotions.

As a representative, you have instant access to the MLS, something which other investors do not have. This fact gives you a competitive edge which you need to benefit from. However, you ought to not limit your search to the MLS just as there are many other sources of off market residential or commercial properties.

Refer to your realty network and look for any homes for sale which have actually not been officially listed on the MLS. In specific, contact clients to whom you sold a house a few years earlier as they may be thinking about purchasing a brand-new larger home in another community.

Don't underestimate the capacity of driving for dollars and have a look at "For Sale" indications in the regional realty market. Another great source of financial investment homes are foreclosures, bank-owned houses, and short sales (how to invest in real estate with little money). To browse through those, you can check out the sites of local banks and other funding organizations.

Ensure to variety your home search as much as possible as each source will supply you with various kinds of properties within various price varieties. The next required action in buying a financial investment residential or commercial property is to perform investment home analysis on a number of various listings. This analysis must be based on rental comps, i.